How to give retired clients a yearly tax-free income

There comes a point in every person’s life when they ask themselves two questions: ‘How much will I need when I retire, and how much have I saved?’

The answers vary from client to client, of course, but a rough rule of thumb is to work out how much an individual (or couple) think they will need to live on each year, and to work out what age they would like to retire at.

Using conservative calculations based on longevity statistics, one could estimate living 20 years after state pension age (currently 67). Assuming one lives to 87, they will need 20 times their desired yearly income.

Most people assume they will need approximately £25,000 to £30,000 a year – which would necessitate a pot of at least £600,000, not taking into consideration any investment growth, inflation or market risk.

Clearly, this varies depending on the client – perhaps their mortgage is paid off, for example, and they do not need to meet significant monthly outgoings.

But however much a client has saved, one always wants to make the pot last longer.

Using the right combination of income, savings, investment income and investment gains can achieve fantastic tax efficiency

One way to do this is to make the most of all the tax allowances and reliefs available, so they can expect a yearly income that does not get eroded by payments to HM Revenue & Customs.

Mark Devlin, senior technical manager at Prudential UK, says: “Simply reaching retirement doesn’t mean that the job is done. Tax planning is for life, not just until retirement.

“How clients access the money built up for retirement, wherever it’s invested – pension, unit trust, Isa, investment bond and so forth – is a key part in making sure that the funds remain sustainable.

"The less tax clients pay on the income or capital you take, the less of the fund you have to take to meet your financial goals."

And, according to specialists, individuals whose advisers are helping them make the most of all the legal tax reliefs could find themselves enjoying a tax-free income of £30,000 a year.

How it works

Rachael Griffin, tax and financial planning specialist for Quilter, says it is possible to "tap into a minimum of £32,870 of your savings a year", using a diverse set of investment products, ranging from pensions to Isas and investment bonds (see below).

The list gives a total of £32,870 plus pension commencement lump sum, Isa and capital withdrawn, assuming the starting rate limit for savings income is available for up to £5,000 for those with income under £17,570.

Griffin comments: "Each of the different products enable you to take home a rather small amount of tax free ‘income’ per annum, but add them all together and you find yourself with a substantial amount."

Devlin agrees: "Using the right combination of income, savings, investment income and investment gains can achieve fantastic tax efficiency."

And while the pension might be the largest pot, it is not the only asset in play. Devlin reiterates: “Clients may have cash in the bank, perhaps boosted by tax-free cash from a pension, along with other assets and investments built up over the years. There could also be buy-to-let income to consider.”

The news is also good for couples, perhaps highlighting the old maxim ‘two can live cheaper than one’.

David Stevens, director of advice strategy for LV, calculates a couple could live tax-free on £33,500 a year and possibly more, allowing for any positive changes in the tax environment (see below).

Case Study 1: The couple

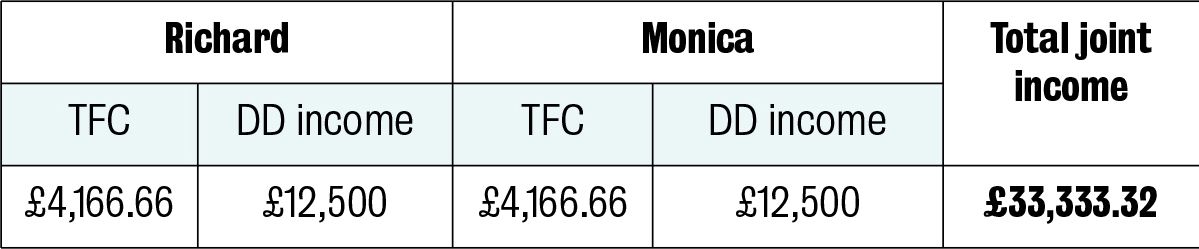

Richard (62) and Monica (60) are looking to retire. They are mortgage free and have no immediate need for a lump sum to pay off debts, but do require a joint income of £33,000 a year (after tax) to live off.

They each have a pension pot valued at around £400,000 and their adviser recommends that they each use part of their tax-free cash allowance to provide the required income, as follows:

The advantage of this approach is that no income tax is payable, since all the drawdown income falls within their tax free personal allowances of £12,500 (for 2020-21).

This means less pension savings are needed to provide the required income. Note that although no tax is due, they are likely to find that tax is deducted (at least on their first withdrawal). They will therefore need to complete form P55 to reclaim this.

The minimum amount necessary to produce the income is drawn from the pension. This allows the remaining tax-free cash entitlements to remain outside of each person’s estate for inheritance tax purposes.

The remaining pension funds can continue to grow within the tax advantaged pension wrapper, including their remaining tax-free cash entitlements.

The tax-free personal allowance has previously increased each year in line with the consumer price index.

Usually, this would allow the couple to increase the income drawn each year in line with inflation without incurring an income tax liability or needing to use a higher proportion of tax-free cash.

That said, rates have recently been frozen until 2026.

Source: LV

However, in the recent Budget, personal tax allowances were frozen from 2021 to 2026, so clients will not enjoy incremental increases in their tax-free income until at least 2027.

There is also a particular order of taxation to bear in mind. Prudential's Devlin says: “Making use of tax allowances and keeping in mind the order that income is taxed is a big issue.

“Not forgetting that, if you’re dealing with couples, you could have double the allowances, so equalising assets could make more use of these.”

Lump-sum savvy

Stevens says one of the most tax-efficient things a person can do is not request their full tax-free cash amount from their pension savings.

This may be a difficult sell; Stevens says many people’s “first instinct” on retirement is to request their full tax-free cash entitlement of 25 per cent of their total pension pot.

Indeed, since pension freedoms came in, the total value of flexible withdrawals from pensions has exceeded £37bn, according to HMRC.

But while it may make sense to use it while you are young enough to enjoy it, Stevens comments: “Unless a large lump sum is needed for a specific purpose, this is not always the wisest course of action.

“It can often make sense to retain most of the tax-free cash entitlement until a later date, looking to use the personal allowance (and potentially the basic rate tax band) to draw tax-efficient income instead.”

Moreover, taking a big lump sum from a pension can lead to a large tax deduction.

Stevens warns: “A one-off withdrawal can be heavily taxed because pension schemes must normally start deducting tax using the emergency code.

“This means the tax system treats the withdrawal as a new monthly income and tax will be deducted as if the payment is a twelfth of the annual income.”

Unless a large lump sum is needed for a specific purpose, this is not always the wisest course of action

This typically results in a large overpayment of tax, which will not be repaid until the end of the tax year. If an individual wants it sooner, they will have to fill out forms to P50Z, P53, P53Z, or P55, so they can reclaim the overpaid tax within 30 days.

According to HMRC data, some £39m of tax overpayments were reclaimed in 2020. Advisers and clients will weigh this ability to reclaim against the time involved in doing so.

Hot property

Away from the pension pot, Canada Life technical director Andrew Tully says property is one of the most under-used assets by clients to generate income or capital.

He explains: “Using equity release in its many formats allows the adviser to generate an income/capital stream to meet the client’s needs.”

Within equity release schemes, any income or capital is not subject to income or capital gains tax and the property will still qualify if it is the main residence for the residence nil rate band. The RNRB is £175,000 per person, and will be held at this level until 2026.

However, Tully warns: “The drawback is the client is taking a loan against the property at an interest rate that must either be serviced or rolled up within the loan until the client dies.

“While the main residence forms part of the estate for inheritance, the loan and any interest accrued will act as a reduction in value of the estate.

“This could be advantageous from an IHT perspective and must be considered when assessing using this form of funding.”

Word to the wealthy

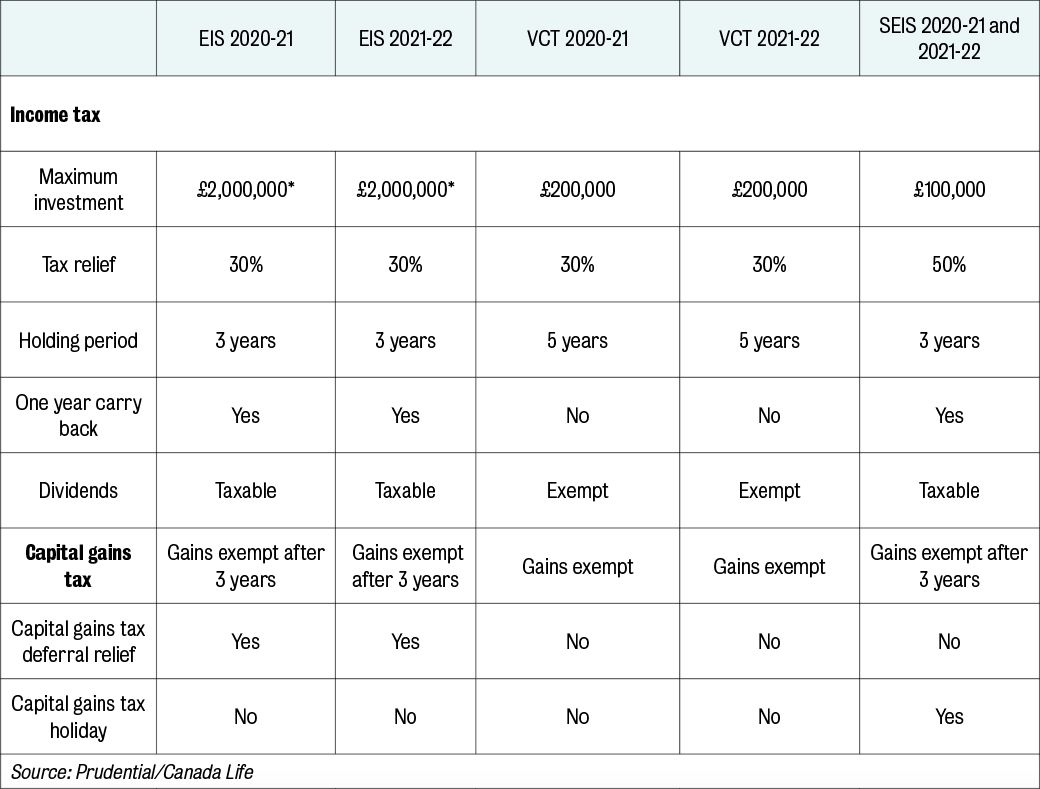

For those clients with much more in the way of investable assets, and perhaps with a greater appetite and tolerance for risk, advisers will know that looking at investments such as investment bonds, venture capital trusts and enterprise investment schemes could boost their tax-free income.

Tully comments: “These arrangements can gain elements of tax relief, shelter some elements of CGT and some offer income tax and CGT relief.”

However, Tully adds: “The important elements when considering these types of arrangements – as well as the risk profile of the client and the suitability of the proposition – are the underlying holdings and whether they will qualify under the rules for business property relief and gain 100 per cent against IHT.”

There is also the question of the lifetime allowance and IHT for wealthier individuals.

LV's Stevens adds: “It can often be advisable to spend or gift their non-pension assets first, which can help reduce the estate for IHT purposes.

“For larger pension pots, there will also be planning points around the LTA, including availability of fixed or individual protection.

“Where a LTA tax charge is unavoidable, choosing how and when would be an appropriate time to incur this is important, as this can greatly affect the overall tax liability.”

Tully agrees advisers need to look twice at the pension for weather clients. As the LTA is fixed at £1,073,100 until 2026, potential taxation on the excess if taken as income is 25 per cent, or 55 per cent as a lump sum.

The key thing is making sure clients have enough net income to meet their essential and lifestyle needs

In addition, advisers need to consider how death benefits are taken before (tax free) or after age 75 (taxed at beneficiary marginal tax rate) for wealthier individuals.

He explains: “If tax-free cash only is taken, ideally phasing these payments, and if the client still has income, they can contribute to a pension up to the £40,000 annual allowance.

“This is useful for a client moving into retirement. Even if they are drawing income and taking tax-free cash, although they would be caught by the money purchase annual allowance of £4,000, they could still contribute £3,600 tax-efficiently to a pension each year.”

Prudential's Devlin adds: “If one half of the couple has a good DB pension, placing assets in the non-DB partner could produce better tax efficiency. If a spouse/civil partner is not using all of their personal allowance, they could use the marriage allowance to pass this onto their other half.

“The key thing is making sure clients have enough net income to meet their essential and lifestyle needs.”

Wider considerations

If a client has sufficient finances and flexibility it is possible to generate £30,000 without incurring any income tax or CGT.

Of course, as Tully states: “The reality is clients are not so lucky and there is a need to create a withdrawal strategy that minimises the taxation consequences.”

Below, Case Study 2, provides an example of a ‘withdrawal strategy’ that can help pensioners take advantage of the most common allowances.

The allowances considered for Margaret’s case are:

- Personal allowance £12,570

- Personal savings interest £1,000

- Dividends £2,000

- Using CGT allowance £12,300

- Total so far £27,870 without incurring income tax or CGT

- Plus access to tax-free income from:

- Phasing tax-tree cash from pension

- Accessing Isa funds

- Equity release

- 5 per cent withdrawals from investment bonds

- Premium bonds winnings etc.

Case Study 2: The single client

Margaret is age 59, single with two children and has a variety of assets as well as some income that will come into payment.

- State pension > £9,000 a year from September 25 2028

- DB > £8,000 a year from September 25 2023

- Crystallised pension worth £125,000 (Pension 1)

- Uncrystallised pension worth £350,000 (Pension 2)

- Isas worth £100,000

- Investment bond worth £150,000

- Property wealth £725,000 (main residence, buy-to-let).

Following a discussion with her adviser, she requires an income of £30,000 a year (after tax), increasing by 4 per cent a year until age 70 and then 2 per cent a year for the following 15 years. She wants to maximise the value of estate of her beneficiaries.

Here the aim is to produce a rising income stream, but with a focus upon minimising the impact of taxation.

The graphs below show five-year blocks and the amount of capital withdrawal from the appropriate assets to provide income over the period from age 59 to 85.

The first process is if the adviser were to use the pension first; the second process is saving exposure to income tax.

The second process produces a slower drain on the assets, despite introducing equity release into the solution. There is also an added benefit in the legacy left to her children.

Also, by allowing the pension to be drawn at a later stage, the pension funds do not form part of the estate for IHT.

While the interest from equity release has been rolled up with the loan, this allows for a reduction in the estate that would be subject to IHT.

Source: Canada Life

Therefore, with the possibility of income generated from various measures, including from National Savings & Investment winnings, there are many ways clients could enjoy a decent retirement without being hit by big tax bills.

But this can lead to complexity.

Tully says: “The adviser is faced with all these available assets with the focus on producing a plan to meet the needs and objectives of their client.

“It might be helpful to consider allocating them to various pots to aid client conversations.”

That said, every client’s needs are different, and naturally there may be reasons why they need to spend a little more one year than another; for example a family wedding or home improvements.

As Devlin comments, there needs to be scope to adjust: “Some income may be fixed, such as the state pension, while some will vary, such as investment income or buy-to-let. So any plans need to have a degree of flexibility built in.”

So while making the most of tax-efficient investments is a great start, this might not be appropriate for every client.

And of course, if clients remain invested, they ought to be in suitable, risk-appropriate investments that reflect their values.

Quilter's Griffin adds: "Tax efficiency should not be the only driver when choosing what products to use. Each product offers different levels of flexibility and your particular financial circumstance will dictate what mix of investments is best."

Simoney Kyriakou is senior editor at FTAdviser